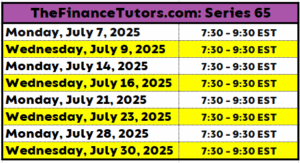

Live Class July 25′ Series 65/66

$250.00

Live Lecture Series 65/66 Course July 25′

Description

Live Class, 16 hours of instruction covering 100% of NASAA outline

Topics on the Series 65/66 Exam including:

- Economic Factors and Business Information (15% of the exam)

- Basic Economic Concepts: Business cycles, monetary and fiscal policies, global and geopolitical factors.

- Financial Reporting: Understanding financial statements and their implications.

- Types of Risk: Understanding different types of risks, such as market risk, interest rate risk, and inflation risk.

- Investment Vehicle Characteristics (25% of the exam)

- Types of Investments: Fixed income, equity, and other securities.

- Valuation: Understanding how to value different investment vehicles.

- Investment Products: Cash and equivalents, fixed income securities, equities, pooled investments, derivative securities, and insurance-based products.

- Client Investment Recommendations and Strategies (30% of the exam)

- Types of Clients: Understanding different client profiles and their investment needs.

- Tax Considerations: Understanding the tax implications of different investment strategies.

- Portfolio Management: Developing a client profile and applying your understanding of risk, and portfolio theory.

- Financial Planning: Understanding financial planning concepts and strategies.

- Laws, Regulations, and Guidelines (30% of the exam)

- State and Federal Securities Acts: Understanding the laws and regulations that govern the securities industry.

- Rules and Regulations for Investment Advisers: Understanding the rules and regulations that apply to investment advisers.

- Ethical Practices: Understanding ethical standards and fiduciary obligations.

- Communication with Clients: Understanding how to communicate with clients in a professional and ethical manner.

- Compensation: Understanding different types of compensation and their implications.

- Client Funds: Understanding how to handle client funds and avoid conflicts of interest.

- Conflicts of Interest: Understanding how to identify and manage conflicts of interest.

Reviews

There are no reviews yet.